Examine Jim Simons' Trading Strategy: A stock exchange is a place where many well-known investors have made their mark. This market has catered to both large institutional and retail investors.

However, some people appear to have cracked the code to massive wealth in the stock market. Jim Simons is one of them. Since 1988, his fund has produced annual returns of 66%.

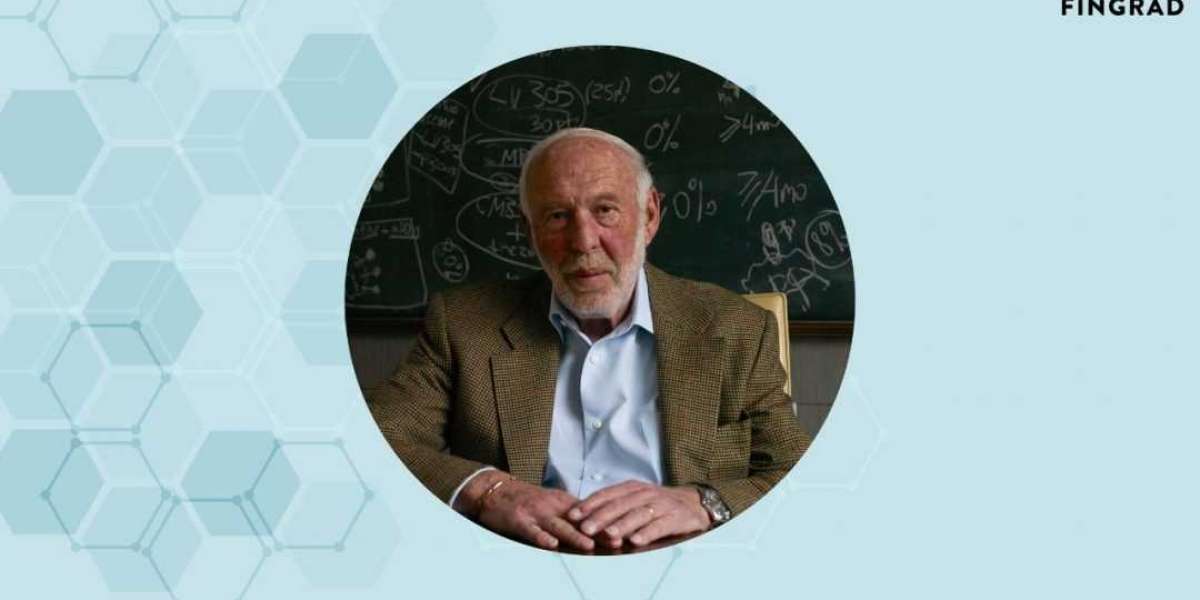

In this article, we will discuss the trading strategy of James Harris Simons, also known as Jim Simons, a hedge fund manager. Who exactly is Jim Simons?

Jim Simons is a well-known investor and mathematician. He is also known as the "Quant King" due to his use of quantitative analysis in his investment strategy. He is also the well-known founder of Renaissance Technologies and its Medallion Fund.

In the early 1980s, he founded Renaissance Technologies. The concept of quant trading was completely unknown at the time. Renaissance became a hedge fund industry trendsetter because the investment firm was able to deliver massive returns and has a distinct operating style.

Between 1988 and 2018, this fund averaged 40% annual returns after fees. Before fees, the fund returned an average of 66.1% on a gross basis. This hedge fund is one of the most successful in history.

The Medallion fund grew at a much faster rate than Warren Buffett's portfolio. The fund has been extremely profitable, and its unit holders pay high fees. The Medallion Fund was a hybrid of a trend-following and a quantitative fund. Read more on: How Jim Simons Trading Strategy gave more than 66% interest Annually?

Search

Popular Posts